A receiver whom rearranges their assets will make it required for a caveat or cost in one home to be eliminated and put onto another. This rearrangement of assets will not change a recipient’s involvement when you look at the PLS so long as the replacement property’s value is recognized as to deliver sufficient safety for your debt. a demand to alter the safety must certanly be on paper and signed by the receiver and their partner if they’re person in a few.

An principle that is underlying of PLS guidelines is the fact that in a couple of situation, no matter whether one or both lovers are trying to get or getting a PLS loan, both lovers know about the regards to the mortgage including any changes. Because of this good explanation, SSAct section 1136(2) and section 1137(2) need that both partners signal the application form for a PLS loan and nomination of or switch towards the fully guaranteed amount, correspondingly. The principle that is same connect with any alterations in assets provided as safety for the PLS loan.

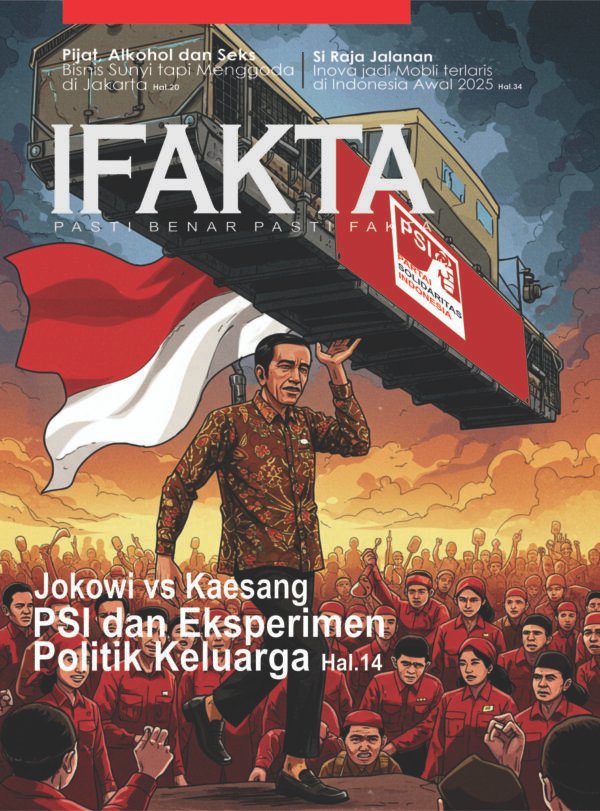

ADVERTISEMENT

SCROLL TO RESUME CONTENT

Transfer of PLS security and/or debt to a different individual

A PLS loan is compensated to a person that is individual the ensuing financial obligation is the obligation of this individual.

Court ordered choice

The place where a court ordered choice transfers PLS repayment and security of debts for 1 individual to some other 1 individual, or transfers payment of debts for just two visitors to only one individual, Centrelink is likely to adhere to the court purchase.

Note: As there clearly was a transfer of ownership associated with the protection, a brand new caveat would have to be lodged from the guaranteed home.

Contract between 2 events

The SSAct doesn’t consider the transfer of a PLS safety and/or debt by contract. Appropriately, such transfer just isn’t allowed. DSS legal services is into the lack of express appropriate authority, it really is not likely the division will be in a position to accordingly evaluate whether someone to which a financial obligation is proposed to be used in, has adequate assets against which to secure your debt. It’s also unlikely there is a appropriate foundation for asserting a cost over their assets. These facets suggest there is a danger that the ability associated with Commonwealth to recover the transmitted financial obligation could be dubious.

Changing the amount that is nominated

In cases where a receiver has specified an amount that is nominated they are able to alter this quantity whenever you want.

A demand to improve the amount that is nominated be on paper and finalized by the receiver and their partner (if they’re an associate of a few).

Lowering of worth of genuine assets

When it comes to purposes of this Age assets test the balance due by way of a receiver underneath the PLS is permitted being a deduction through the value of this receiver’s assessable assets utilized as safety for the loan. The value of the recipient’s assessable assets (i.e. the net value) normally decreases as the amount owing increases with each payment made under PLS. This nevertheless, depends upon whether or not the gross value of the asset is appreciating. If the assets are decreasing in web value, any retirement payable underneath the assets test may increase.

NO decrease in the general worth of assets will happen in the event that pensioner’s major house could be the security that is ONLY your debt.

Explanation: The principal house can be an exempt or non-assessable asset.

In the event that PLS loan is guaranteed by assessable genuine assets as well as the pensioner’s major house, the entire worth of the mortgage is deducted through the worth of the assessable asset.

Explanation: The apportionment of encumbrances guidelines try not to connect with PLS loans.

Act reference: SSAct section 1121(4) if you have an encumbrance or charge over assets …

Excluded assets

Any genuine assets excluded from evaluation underneath the PLS need certainly to be studied into consideration whenever calculating someone’s entitlement to retirement beneath the normal assets test conditions.

Other folks with passions within the genuine assets

Often someone else, apart from the receiver or their partner, has a life interest (1.1.I.185) within the asset that is real has been utilized to secure the PLS loan. In this situation:

- The value that is current of life interest has to be acquired, and

- the worthiness of this life interest decreases the equity that the receiver’s property has when you look at the genuine asset (see explanation).

Explanation: it has the consequence of reducing the protection for the loan and perchance decreasing the optimum loan the individual has the capacity to get.

Certification of Title

A certification of Title (long rent) produces a ‘real home right’ for someone and satisfies the thought of ‘ownership’ of genuine assets for the purposes of SSAct area 1133.

A certification of Title will not reduce that protection protecting the Commonwealth’s passions.

Example: When an individual sells their house when you look at the ACT (ACT leases), while theoretically they have only a ‘lease’ regarding the land component, the individual, perhaps not the ACT Government, gets the economic advantage of the land value for sale. In which the ACT Government did reclaim land topic to a certification of Title, the person/s impacted would get economic payment (like in normal circumstances the individual cannot just just take their real house with them). The Commonwealth’s interest should nevertheless be protected.

The existence of A certification of Title will not preclude the Commonwealth from searching for re payment of a PLS that is outstanding debt nor does it avoid a person/s from attempting to sell their house.

Act reference: SSAct section cash central 1133 Qualification for involvement in PLS

Partners

People of a few applying underneath the PLS are both needed to signal the mortgage application, even when the provided safety is entirely owned just by one user. The application is not a valid request to participate in the scheme without both signatures.

Act reference: SSAct section 1136(2) dependence on a demand to engage, section 1135A(1) aftereffect of involvement in PLS-maximum loan available